The answer is simple, when it’s a value problem.

Value is the relationship between the quality of an organization’s product or service offering and the price that they charge for it.

In many organizations it fairly common to hear the sales and marketing people urging price cuts. Cutting prices can be a major mistake for two critical reasons. The first is that price cuts typically do not provide a sustainable advantage to the firm initiating them. They are extremely easy to neutralize and counter. Once counter or neutralized all organizations are left with reduced margins unless the cost can be offset elsewhere. The second is that they can lead to what we call the commodity trap. Reducing price reduces margins that beg cost cutting elsewhere to maintain margins. Among other things, this means reducing budgets for product or service support, reducing call center activity, reducing on-time delivery capabilities, reducing parts availability, and cutting back on labor. In other words, reducing price leads to cost cutting that further deteriorates quality and leads to a sameness across competition. Once an organization’s product or service falls into the commodity trap it is extremely difficult to climb out of it. Gone is the compelling reason to buy an organization’s product or service. From the customer’s point of view, it doesn’t matter which product or service they buy, they are all the same!

Justifying an organization’s pricing policy should focus on the question, “how do we increase the quality that we are providing targeted markets so that our price is justified?” In other words, how do we increase the value of our offering? The first step is understanding how targeted markets define value.

Understanding Value

Before companies begin their journey toward the commodity trap they would be well advised to challenge themselves regarding how their targeted markets define value. Not all markets they choose to serve will define value in the same manner. Heavy equipment manufacturers serving construction and agricultural markets will most certainly be dealing with multiple definitions of value. Telecom providers serving both commercial and residential users will likewise have to deal with differing definitions of value.

Organizations must begin a value dialogue with their targeted markets. They can’t rely upon internal definitions of value. These internal definitions of value tend to be extremely reductionistic in nature focusing simplistically on product features. Customers do value unique features but want a lot more. In study after study, customers identify such factors as dealer service, parts availability, sales competence, problem resolution, shopping convenience, and other non-product/service related factors.

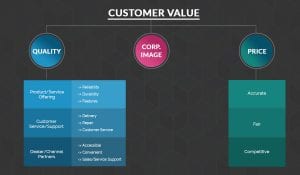

A more holistic and customer centric view of quality can be seen in the following figure:

Customer value is comprised of three major drivers:

-

quality

-

image

-

price

The major challenge facing organizations is to understand the key critical-to-quality factors that comprise the quality component of value. It is these factors that when properly executed justifies the price charged.

As the figure indicates, product features occupy an important role in quality. Product features are often necessary but non-sufficient conditions for value. Other factors such as customer service and support are critical. These might include the organization’s capacity to provide repair services, sales service, on-time delivery or customer service after the sale. Quality will also include factors such as sales support at the dealer, broker or branch level, as well as convenience, and accessibility. These are a few of the many types of factors that your customers will indicate as important in their definitions of quality and value. The organization’s value delivery system must incorporate these factors into it.

Managing Value Requires an Integrated Effort

Six Sigma initiatives targeting issues such as product support, sales support, parts availability, etc. will provide enhanced quality and improved value. At the same time there is a strong probability that the organization will find ways to provide this enhanced quality at a lower cost.

It is interesting to note that many of these critical-to-quality factors may not be under the direct control of the manufacturer or company providing initiating the service. Execution on these factors will require a strong relationship with middlemen, brokers, agents, dealers, and branches. A super regional bank can talk all it wants to about its superior quality but if that quality is not experienced at the local branch level, quality is not being delivered and value is not manifested. Not being able to properly fix a customer’s car at the local dealership diminishes the manufacturer’s claim about a reliable and dependable automobile. Sending customers to a grocery store to buy a food product and then not having product available induces many to buy a competitor’s product that is available. An inability to process an insurance claim because the provider has a slow processing system showers blame on the agent. All of these issues brings into question whether the price that an organization charges for its products or services is justified. When sales resistance ensues, price may not be the issue.

Six Sigma initiatives must follow the value stream that produces the value. This complicates issues somewhat since it requires the participation of multi-layered channel partners. Banks must include branches, equipment manufacturers must include dealers and other logistics partners, insurance companies must include their agents, and food companies must include retailers who carry their products.

As a manufacturer or service originator, simply advertising that you provide quality or value does not mean that you do. Many originators of a service or manufacturers of products believe, probably intuitively, that value and quality at the point of production automatically translates into value or quality at the point of consumption. Reductionistic efforts to enhance quality solely on the floor shop ignore the greater reality that the customer employs in defining value.

Increasing value means that the organization and its middlemen must work more closely in reengineering the shared value delivery system. Dealers or agents are often blamed for a lack of quality service when the blame squarely resides with the manufacturer or originator of service. They are partners in the value competition that will determine which competitor will enjoy greater market share and profitability. An enhanced quality offering reduces price resistance because customers now see greater value. The number one question organizations must be able to answer is a simple one: “Are our products or services worth it?”